The last day of the Workshop II of Academic Working Capital, on July 20th, raised discussions about financial planning. The schedule began in the auditorium of the Electrical Engineering building of the Polytechnic School at the University of São Paulo (USP) with a lecture about pricing. Administrator and mathematician Daniel Barzilay explained that the process of pricing in a startup is different from big companies, as these have a wide database of consumer behavior. “In a startup you do not have that luxury, it is much more sensitive and qualitative”, he said. Daniel pointed out strategies and tactics that startups can adopt to price their products and highlighted the need to think of the competitors to define your actions.

See how was the first and the second day of activities

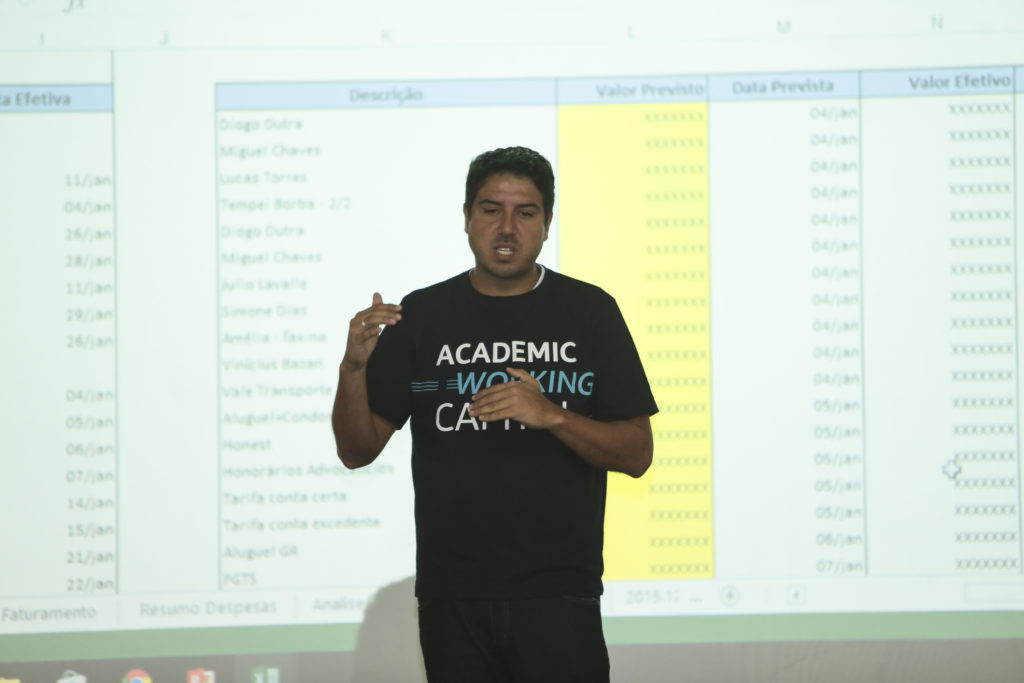

Miguel Chaves, partner of the innovation and design consultancy CAOS Focado, talked about cash flow and the basic planning that every company should have. He showed several charts and graphs to give an example of how to control the cash flow in four stages, until arriving in a financial report. “When we understand the cash flow, we are able to plan the future and grow in a stable and organized manner”, he said. This process helps to understand the dynamics of the company and impacts all areas, not limited to the financial sector. “Decision-making in the company becomes more intelligent,” stated Miguel.

The metrics used to follow the performance of a company were presented by the founder of startups Tegris and FieldLink, Rafael Gonçalves. In his lecture, Rafael talked about some fund raising models and how to measure the traction of the company. “Traction is the ability to attract new users to your product, preferably paying users”, he explained. Students learned about the meaning and relationships between terms such as customer acquisition cost (CAC), lifetime value (LTV) and monthly recurring revenue (MRR). “The strategy is how am I going to leave my business irresistible, is to show that I grow to numbers that my investors don’t even think of dreaming,” he concluded.

The following lecture has fund raising as its theme and was given by Alessandro Andrade, co-founder of startup Lean Survey. It was addressed the difference between venture capital funds and angel investors and the care that must be taken to seek and receive an investment. “Knowing who your investor is and what he brings to your company is worth more than the money he is putting”, he stated. One of the points of attention was with the types and clauses of the contract signed with the investor. Alessandro reinforced the importance of not leaving open clauses and to work so that they are well defined and fulfilled.

The founding partner of Radix Flávio Waltz closed the lectures with a presentation of the history and the work carried out by the company, that offers solutions in software, industrial automation and engineering. Flávio told how Radix faced times of crisis and a major court battle and has established itself as a reference in the sector, expanding the served segments and opening offices in Brazil and abroad. He also commented about the value of university students in the company, which has partnerships with several universities and sponsors academic teams. “We treat universities as our base category.”

The AWC groups completed the documents created during the Workshop and began to think about pricing issues. The program content coordinator, Diogo Dutra, ended the day with information about the work to be done in the second semester and made room for students to share their impressions of the three days of activities and suggestions for the next Workshop, to be held in December.