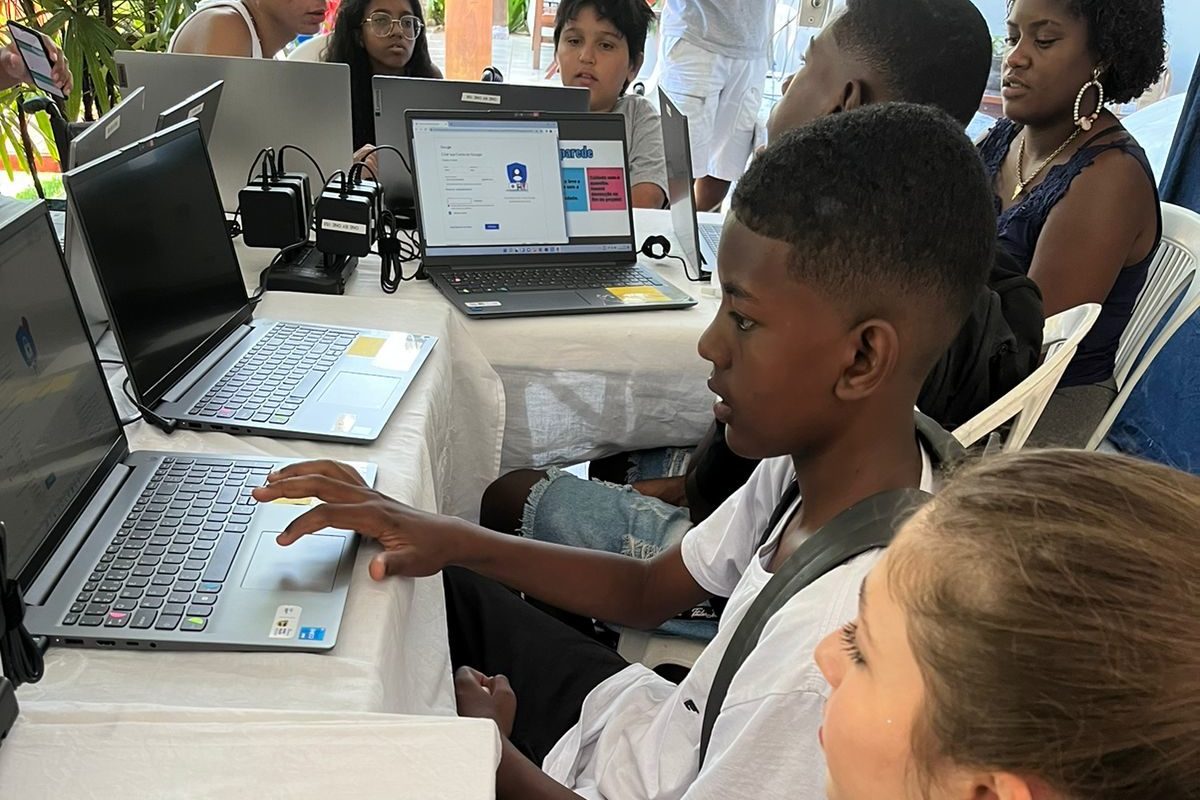

Image: The angel investor Marco Poli at the Intermediary Investments Fair, in July.

Expectations for the Academic Working Capital 2017 Investments Fair are high not only among the groups, but also among investors. Marco Poli, angel investor of Anjos do Brasil, has already participated in the program’s workshops as a speaker, attended the Investments Fairs of 2015 and 2016 and intends to honor this year’s edition, that will take place in December 13th, starting at 10 am, at the Technological Park of the State of São Paulo (São Paulo-SP).

You can register freely for the Investments Fair at the AWC website.

“I got to know the projects in a very initial context [Intermediary Investments Fair, in July], and now I am looking forward to see their evolution,” he says. According to Marco, even if the groups cannot manage to have an investment in the event, it is a very important moment for other members of the entrepreneurship ecosystem to get to know and follow the projects. “This is the time in which they can actually get in touch for the first time with people who invest in projects in the initial stage.” Marco himself remains in touch with groups from previous editions, such as MVisia, which participated in 2015 with a selector of eucalyptus seedlings. He is helping the startup to evaluate a proposal of investment.

Eduardo Grytz, director at Acelera Partners and member of the AWC Board of Consultants, also got to know the projects of 2017 during the Intermediary Fair and considered them highest level. “They are coming very prepared for this challenge and with a good understanding of the market’s problems and needs. The projects are also very well technically designed,” he says. Eduardo adds that the dialogue between the market and the universities is ideal for innovation. “The importance of the Fair is that it is precisely the most delicate moment of innovation: when the student leaves the academic universe, where everything makes sense, and hears from the investor about the real needs of the market,” he states.

Both investors emphasize the need of entrepreneurial education in the universities. “The future belongs to entrepreneurship. We need to be able to create new realities, and this is done with entrepreneurial education, in any field,” Eduardo highlights. Marco explains that the entrepreneurial education needs to show that the entrepreneurial process is multidisciplinary and that other capabilities must be valued. “In Brazilian universities, the students have a deep knowledge of technical or management areas, and to be able to undertake you need to have a mix of both,” he says.